Five Automotive Connectivity Trends Fueling the Future

Dynamic trends in automotive connectivity and technology are transforming the automotive industry. Incredible strides have taken place in a few short years, but the best is yet to come. Technologies such as artificial intelligence (AI) and next-generation advanced driver assistance systems (ADAS) along with increasing V2X infrastructure are moving the industry closer to autonomous driving functionality.

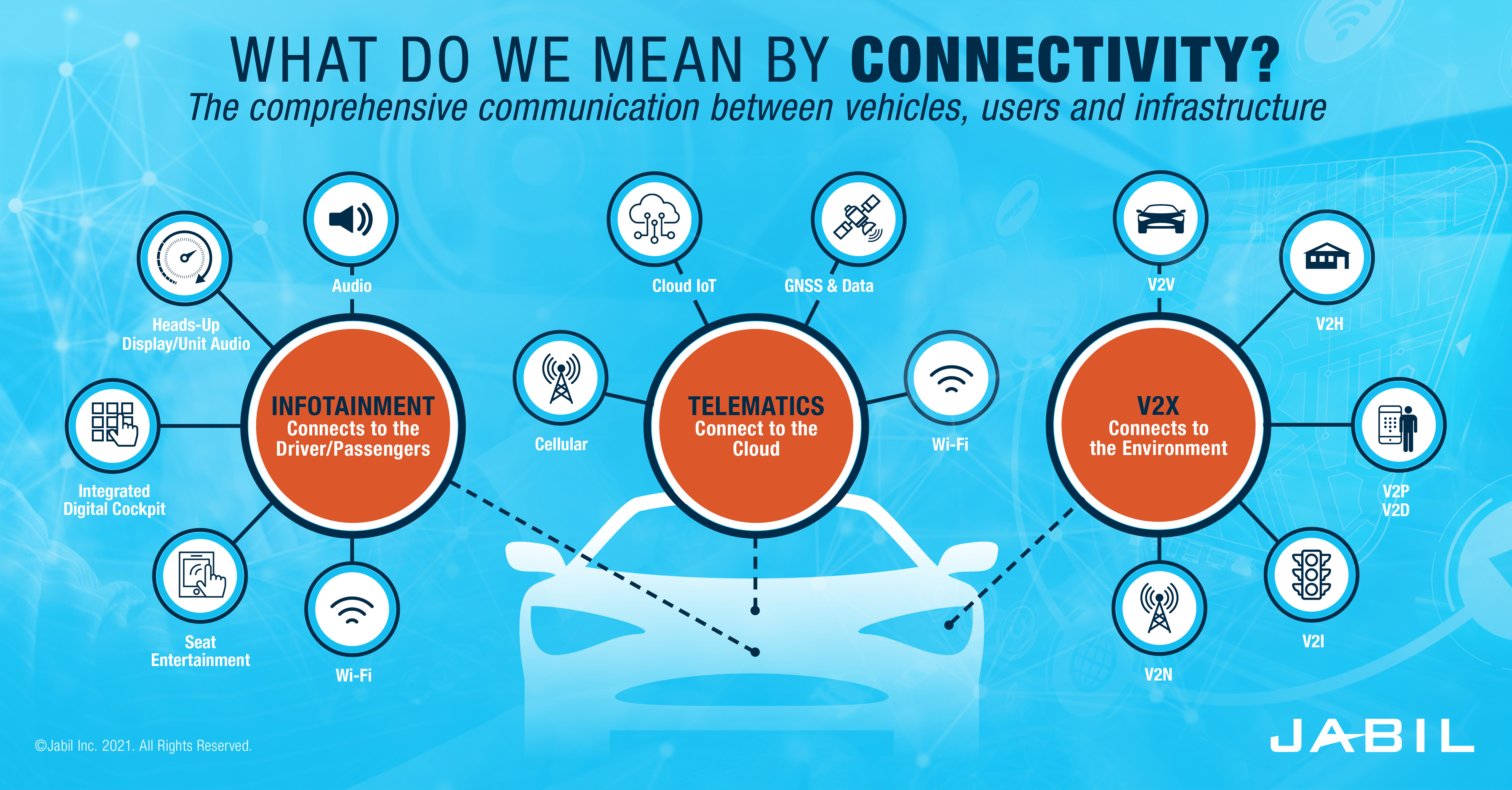

Vehicle-to-everything, or V2X, is an all-encompassing term for a vehicle's connected communications, including: vehicle to vehicle (V2V), vehicle to infrastructure (V2I), vehicle to home (V2H), vehicle to cloud (V2C), vehicle to pedestrian (V2P) and vehicle to network (V2N).

Customers are demanding more from their mobility experience — enhanced navigation, personalized in-vehicle infotainment (IVI) systems, predictive maintenance and over-the-air (OTA) updates.

All of these capabilities rely upon the technical foundation provided by vehicle connectivity. In fact, the underlying technologies driving vehicle connectivity also intersect with increasing levels of vehicle autonomy and electrification. The trends reinforce one another, and the industry's transformation is being powered by synergies between them.

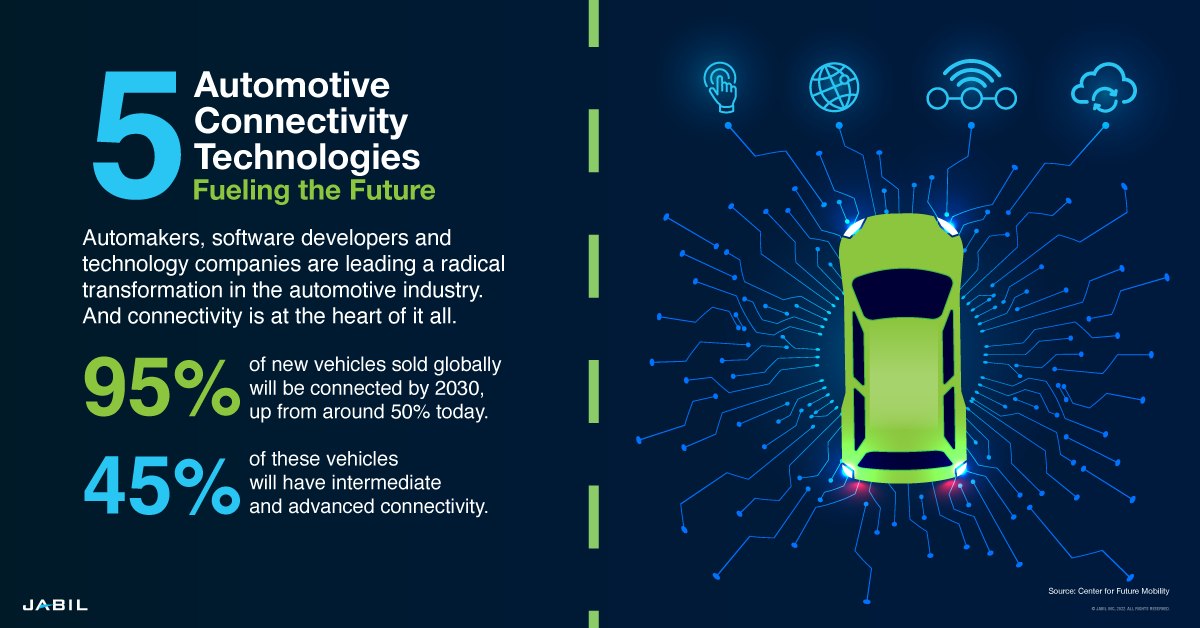

According to McKinsey, by 2030 about 95% of new vehicles sold globally will be connected, up from around 50% today. Around 45% of these vehicles will have intermediate and advanced connectivity which — per McKinsey's connected car customer experience framework — includes features like access to personal profiles for digital services, ecosystems and platforms, multisensory interactions for all occupants, and intelligent decision-making through seamless linkages to the environment.

In just the United States, which has the largest percentage of connected vehicles, ABI Connected Car Market Data reports 91% of new vehicles sold in 2020 were connected. Figures for Asia-Pacific and Latin America were 51% and 37%, respectively.

Connectivity essentially establishes cars as nodes upon the Internet of Things (IoT), so that in addition to providing safe transport, people's vehicles increasingly function as a service delivery platform. This is where interdependencies between onboard telematics, which connect the car to the outside world, and cloud-enabled services and software are charting the connected vehicle into the future.

.jpg)

Moving in parallel and with increasing momentum, here are five broad automotive connectivity trends to keep an eye on as the industry cycles through development, adoption and refinement of the technologies driving vehicle connectivity.

Trend number one describes a major inflection point, with dramatic impacts across the entire mobility ecosystem: We have entered the era of the software-defined vehicle.

1. The Era of the Software-Defined Vehicle Has Arrived

As one of many industries undergoing digital transformation, automotive OEMs are adopting to a new paradigm — for Jabil Automotive and Transportation customers, this is the shift from hardware to software-defined vehicles.

What is a Software-Defined Vehicle?

"Software-defined vehicle" is a term for conceptualizing the industry's shift from a static, electromechanical-focused product to an upgradeable, platform-based mobility solution in which the architecture of the vehicle is defined by the software, not the hardware.

Tesla was a first-mover, expanding the limits of traditional automotive software by designing a computer network and then building vehicular firmware around it. The concept is to think of a car, like today's electric vehicles (EVs), as essentially a high-performance computer (HPC) on wheels, with software providing the means for a personalized, two-way "conversation" between vehicles and their manufacturers, as well as enabling connections across the entire ecosystem.

Here are some examples of the range of services the fully connected car's software can deliver:

- Highly automated driving functionality,

- Advanced human-machine interfaces (HMIs), like AI-powered virtual assistants,

- Enhanced driver services, like smart access, virtual reality heads-up displays, theft prevention and vehicle tracking, emergency assistance, navigation, and other travel intelligence,

- Personalized infotainment that moves with you,

- Customer engagement insights that drive improvement back up the value chain,

- Telematics for driving prediction services and additional optimization,

- Over the air updates (OTA) and quality fixes.

According to research from MarketsandMarkets, automotive software is projected to be a $40 billion market by 2027, with 13% CAGR — driven by software validation and software integration capabilities. Just the connected assistance systems enablement alone is invaluable: millions of hours of driving time saved by connected parking functions, billions saved in material damage and accident avoidance, and fewer people injured or killed in those accidents.

To deliver all these functions, today's EV can have up to 150 million lines of software code, distributed among as many as 100 electronic control units (ECUs) and a growing array of sensors, cameras, radar and light detection and ranging (LiDAR) devices.

In terms of how much data tomorrow's connected cars will be processing, estimates vary greatly. At a recent online conference for intelligent mobility, Dowson Tong, senior executive vice president of Tencent and CEO of the company's Cloud and Smart Industry Group, suggests that within autonomous vehicles, and depending on the autonomy level, self-driving cars generate anywhere from 8 to 32 terabytes of data for every eight hours of driving.

This massive payload of data needs to be processed and distributed securely and safely, at very low latencies, between various domains. Hybrid electrical/electronic (E/E) architectures will likely be the norm for a while as a more centralized, cross-domain solution emerges.

One thing, however, is abundantly clear: The "ones" and "zeros" of the digital world are increasing dramatically as the software-defined vehicle accelerates into the future.

2. Connectivity Is the Foundation of Autonomous Driving

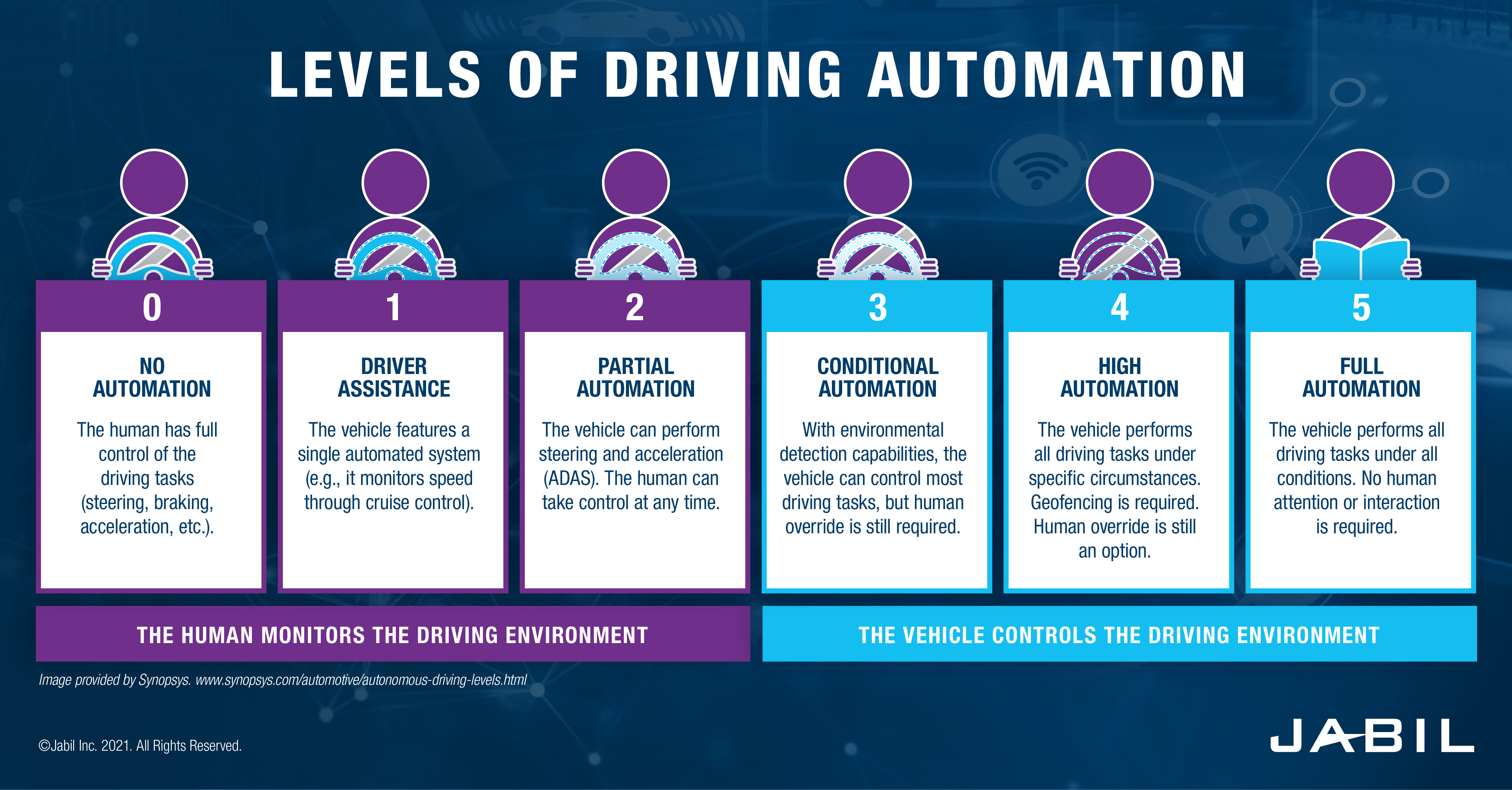

Software is also significantly widening the lane for greater access to emerging V2X features — in tandem with the accelerating ramp towards autonomous driving capabilities. Autonomous driving's demands are significant, requiring increasingly sophisticated software engineering to process, manage and distribute the data volumes generated by detection protocols.

Automotive connectivity is a foundational pillar for autonomous vehicles. Highly automated vehicles require a wide variety of sensors (LiDARs, RADARs, ultrasonic sensors and image sensors), as well as a range of processing subcomponents - all of which demand reliable, seamless connectivity for facilitating V2X functionality.

But don't expect to see widespread acceptance of completely autonomous vehicles for at least another decade due to the need for a fully connected infrastructure and advancement of other technologies as a foundation for ensuring safe operation and functionality.

Connected vehicle applications generate rich volumes of data between car, and cloud. Since data cannot make a round trip to the cloud in time to support the real-time decision-making requirements of autonomous vehicles, edge computing (within vehicles and the edge-enabled infrastructure provided by V2X) needs to evolve to assure safe and secure performance across the overall ecosystem.

5G networks are deploying today (and 6G will follow right behind) that provide the broad coverage, speed and low latency needed for these anticipated advances in transportation. But vehicles still need to be able to assess and operate with base functionality within the car, independent from external connectivity. If the navigation connection goes down, the vehicle still must have enough knowledge to function and figure out where it is and what it needs.

For example, when going through a tunnel if the GNSS (Global Navigation Satellite System) signal is lost, an automotive dead reckoning solution uses motion sensors and other internal calibrations generated within the vehicle to estimate its position.

Dead reckoning technology complements traditional GPS or GNSS navigation through leverage of algorithms for processing navigation data (i.e., changes in distance, direction and elevation) while a vehicle's satellite signal is interrupted.

In a recent interview on CNBC, Adam Jonas, Morgan Stanley's managing director, Global Auto & Shared Mobility, spoke of anticipation for Apple's autonomous driving initiatives, confirming the deliberate pace for the industry making the transition through L3 to L4 and L5 autonomy levels. "We expect L5 (fully autonomous) vehicle penetration to ramp very slowly due to a host of technological and moral/legal/regulatory considerations," Jonas said.

He also asserted one of the primary benefits of self-driving cars, unlocking productivity per the "...more than 600 billion hours per year of driver and passenger time currently spent in vehicles."

Connectivity technology is core to what's next, setting the pace for an evolution of autonomous driving that will continue to be complex, collaborative, and ultimately, transformative.

3. V2X — Paving the Superhighway for Tomorrow's Smart Mobility

Figuratively speaking, connected cars are traveling two roads simultaneously. While one is physical and earthbound, with wheels literally on the ground, the other is unseen, a data superhighway being constructed through a collaboration of public and private investment. This evolving ecosystem is the province of "vehicle-to-everything" (V2X) technologies.

Enabled by sophisticated telematics and other connectivity protocols, V2X makes it possible for vehicles to communicate with each other — as well as other connected elements comprising the infrastructure of "smart cities," such as smart traffic lights, railroad crossings, etc. A fully developed V2X future will enable, essentially, all actors on or near a road to communicate their position and trajectory back and forth, in near real-time, via a mix of complementary communications services, including cellular, short-range radio technology, broadcast systems as well as additional networking elements, like unmanned-aerial vehicle (UAV) and satellites.

Imagine vehicles preventing a collision by "talking" to each other and traffic signals changing in real-time based on current traffic conditions, or your car "knowing" where there's an available parking spot. These are some of the benefits of the advanced automotive connectivity landscape, changing year to year.

In 2020, the FCC retained the upper 30 MHz of the 5.9 GHz Band for Intelligent Transportation System (ITS) operations, and the industry applauded the unanimous vote to modernize the rules in this spectrum to allow both Wi-Fi and automotive safety tech to operate. Final decisions regarding the band allocation are pending.

What's important to note, is that full deployment of low latency, high bandwidth information exchange platforms (i.e., 5G, 6G and future connectivity networks) will enable this IoT "system of systems" to deliver extraordinary value. It has the potential to revolutionize the roads with a truly "smart" system that will save lives, reduce congestion and promote more sustainable modes of travel.

4. Vehicle Architectures — No "One Size Fits All"

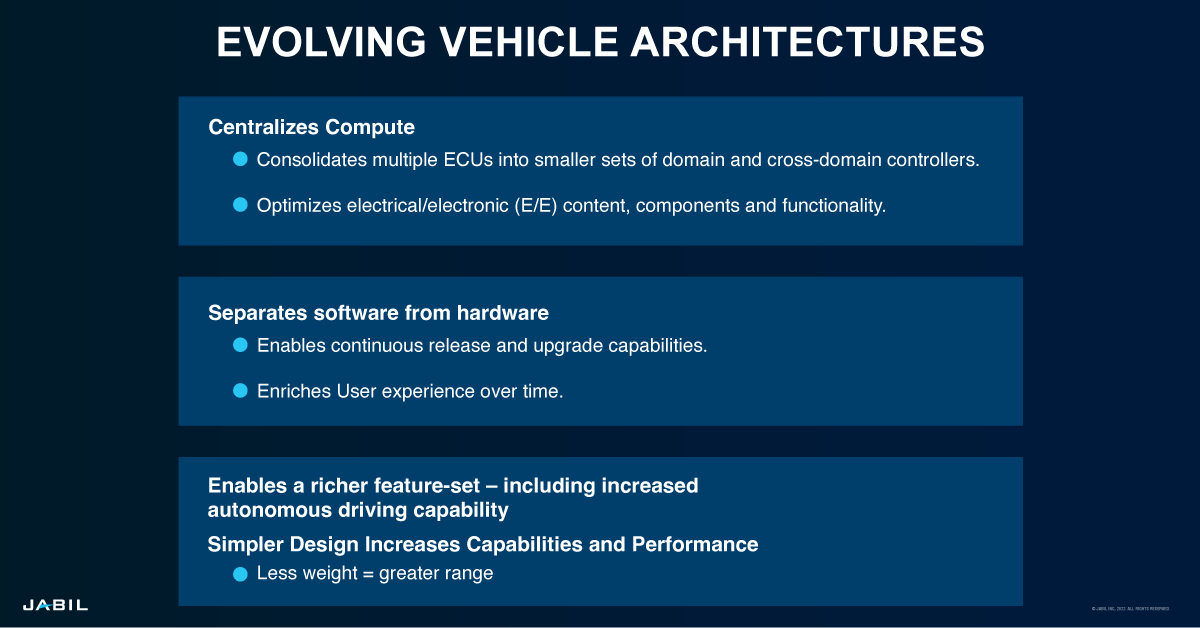

As the increasingly software defined vehicle picks up speed, trend number four traces the impact upon vehicle hardware architecture.

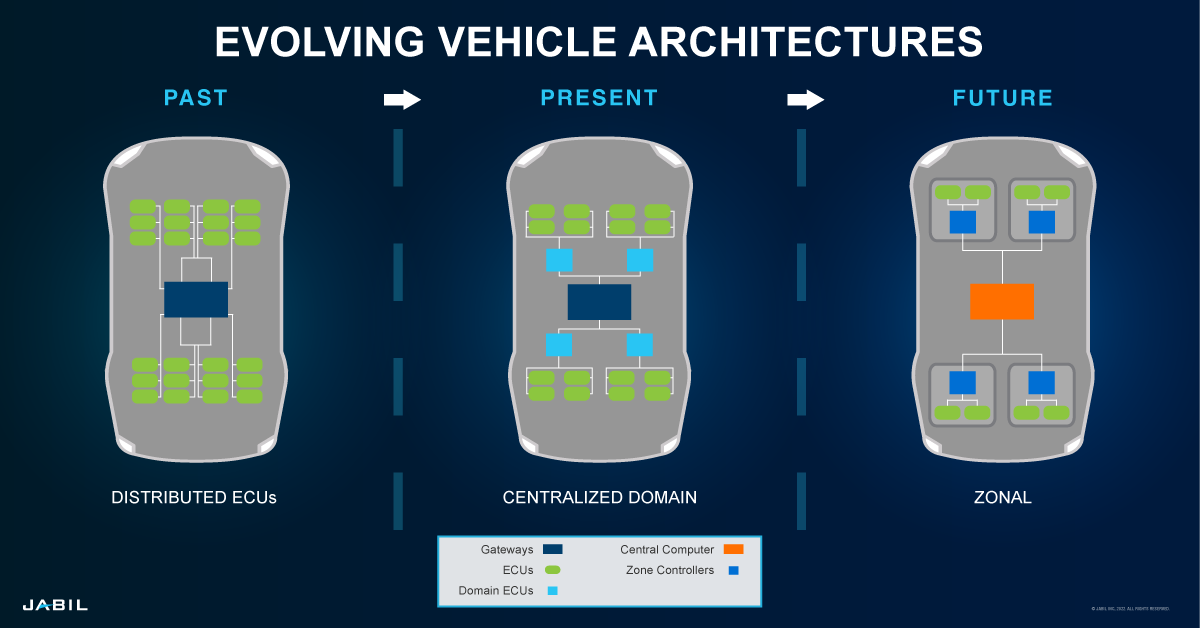

Connected cars generate data... lots of it. To process the ever-increasing amount of data being produced, EVs require high performance processors and high-speed network communications to distribute it more effectively and efficiently. As a result, vehicle architectures are evolving and becoming more intentionally centralized to better master the growing complexity.

EV hardware which once contained up to 100 individual electronic control units (ECUs) are now evolving towards architectures comprised of a handful of high-performance computers (HPCs). Another way to look at this: Where in the past there was one hardware element for one function, now there needs to be one hardware element for many functions.

This consolidation of vehicle functions has enabled developers to simplify vehicle designs, increase driving performance, reduce vehicle weight and hardware costs, and lay the foundation for next-generation features such as wireless software updates, improved security and safety, and complete self-driving capabilities — in other words, all the transformative services being delivered by the software-defined vehicle.

Per calculations detailed within a DISH Wireless white paper released earlier this year, today's connected car generates multiple gigabytes per hour of data, and the volume of vehicle-generated data continues to grow. This has catalyzed a migration path for vehicle architectures from highly distributed systems to domain-based systems and eventually to a centralized control system. In turn, this is changing telematics architectures, putting greater dependency on off-board processing capability (i.e., AI in the cloud) and requiring centralized gateways managing multiple domains and processing capability.

As the software and hardware requirements of the software-defined vehicle proceed in parallel, the direction of travel is towards high-performance platforms for compute, leveraging centralized and cross-domain architectures that are more flexible and empowering than where we are today. This will allow for agile software development, (i.e. additional feature delivery) right up to vehicle launch and beyond, ensuring the customer experience is the best that it can be as the car rolls off the assembly line and throughout its lifecycle.

It will be critical for automotive brands to develop software stacks that are upgradeable over the entire vehicle lifecycle. Keeping the software "fresh" is critical to any future-proofing strategy and building and sustaining customer loyalty.

One thing is certain: As the EV's hardware architectural transition unfolds, there will be no one-size-fits-all solution that can be bought cost-efficiently off the shelf. Customizations for inputs, outputs and scalability will be necessary even as the hardware becomes more standardized — which actually means more "open," similarly to how the PC industry has evolved.

5. Customization and Personalization — It's a Two-Way Street

Vehicles include more technology than ever before, providing almost unlimited opportunities for personalizing customer engagement. Integration with a person's digital lifestyle is becoming increasingly important to customers on par with, or more important than, preferences towards a car's physical appearance or factors related to mechanical performance.

Consider the seamless and portable user experience delivered by connectivity and software tech enabling a person's digital life — their subscriptions and preferences — to literally travel back and forth from "in-home" to "in-vehicle," via the flip of a software switch.

This is a once-in-a-generation inflection point for OEMs to redefine user experience across their stable of brands. It's a chance to holistically integrate the driver and passengers' external wants with their in-car needs, enabling powerful connections and loyalties for their customers throughout their transportation journey.

As tech and software become more decisive factors for the industry, traditional automotive OEMs will either verticalize, ramping software engineering in-house, and/or solve those challenges via long-term partnership or joint ventures with big tech or others within the growing automotive ecosystem.

Think of the mobile phone and how its platform model has enabled an "always on" two-way conduit for continuously updating services while aggregating information on how the user interacts with their product. The fully connected car of the future is likewise an open and flexible hardware platform that can run any software for fulfilling a wide array of on-board or off-board services. It is also a powerful tool for generating revenue long after point-of-sale.

Over-the-air (OTA) updates provide a range of benefits — eliminating disruptive trips to the dealer, fine-tuning and monitoring performance, and delivering software patches without requiring a recall. Today, estimates per a leading global advisory firm already project that as much as 40% of all automotive recall campaigns are remedied with a software update.

Connectivity delivers the data and engagement infrastructure for enabling a much more personalized and informative portal that delivers service, value and, ultimately, a stronger bid for a customer's loyalty. Unfortunately, connectivity also opens the door for potential security challenges in the form of cyberattacks.

Recognizing the risk, the industry's two largest standards bodies — SAE International (SAE) and the International Organization for Standardization (ISO) — produced in late 2021 a groundbreaking new global automotive cybersecurity standard, ISO/SAE 21434, Road Vehicles - Cybersecurity Engineering.

Solving cybersecurity challenges is at the core of a smarter transportation future and a goal shared globally by all players across the ecosystem. Industry analysis underscores the opportunity, with projections that by 2027, automotive cybersecurity will have grown into a $2.7 billion market.

Innovation Catalyzed Through Connectivity

The automotive industry and indeed, the broader mobility ecosystem, are engaged in a transformation catalyzed by the emergence of the software defined vehicle - a shift accelerating in tandem with the build-out of an increasingly robust and distributed communications infrastructure delivering connectivity to the car.

Both the incumbents (traditional OEMs and tier ones), as well as those from adjacent industries (Big Tech, software developers and telecom providers), know the shift is here, and they are preparing and structuring how they will offer to meet the market's new demands. The product is becoming the platform, and it's likely one that will be subscription and services driven — an ecosystem with many partners and players — all empowered by how software facilitates innovation.

Things like infotainment delivery, OTA updates, design optimizations and product cycle planning based on real-time usage data are dynamic customer-centric use cases and validations of what's been accomplished technically to get the industry where it is today.

However, the increasingly connected car's greatest value lies in its fulfillment of a more informed and intelligent mobility infrastructure, one that makes traveling easier, less stressful, safer and more sustainable for all.

How can Jabil support your connected vehicle project? Contact us.

No matter how complex or demanding the project, we’re leveraging our expertise in bringing automotive connectivity to market. Get started with a trusted partner.