To Our Employees, Customers, Investors, and Other Stakeholders

At Jabil, sustainability is the integration of environmental health, social responsibility, governance, and economic growth to create thriving, healthy, diverse, and resilient business operations for our employees and the communities in which we live and work... for this generation and generations to come.

We understand our responsibility to be good stewards of natural resources and positively contribute to global environmental and social challenges. We listened to our stakeholders and developed our strategy and goals in alignment with the social and environmental challenges they care about most, and the areas we believe we can make the biggest impact.

We have established three pillars that form the foundation for our global sustainability efforts.

Our Sustainability Pillars

Our People & Communities

Focusing on the health and well-being of our people and the communities in which we operate.

LEARN MORE

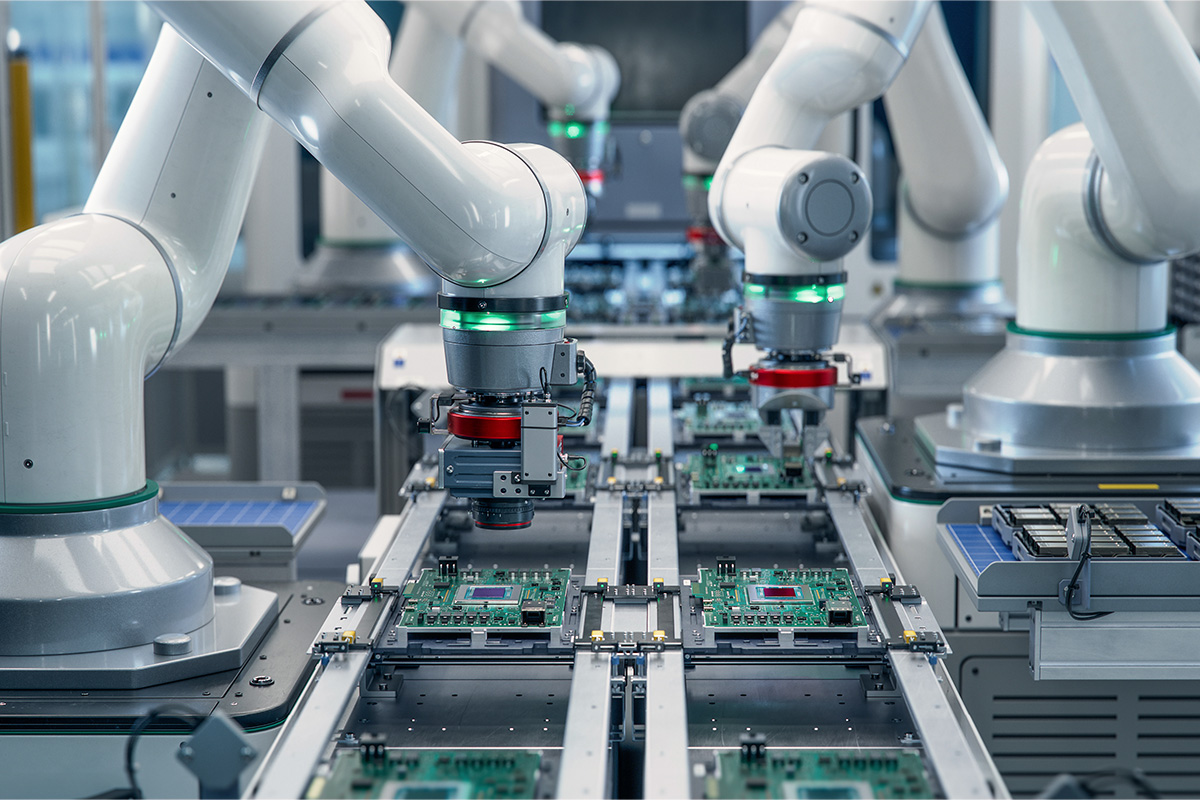

Our Operations & Resources

Ensuring we operate and manage resources in our sites as efficiently as possible.

LEARN MORE

Our Innovative Solutions

Delivering sustainable innovations throughout the product lifecycle.

LEARN MOREDownload our sustainability fact sheet

Our Awards and Recognitions

America’s Climate Leaders 2025 | USA Today

EcoVadis Gold Rating | EcoVadis

America’s Greenest Companies 2025 | Newsweek

Contributions to the UN's Sustainable Development Goals

We contribute to the achievement of the following United Nations Sustainable Development Goals:

SUSTAINABILITY REPORT

Download our fiscal year 2025 Sustainability Report to learn more about Jabil’s sustainability commitments, progress, and reporting. The report includes updates aligned to the Global Reporting Initiative (GRI), the Sustainable Accounting Standards Board (SASB), and the Task Force on Climate-Related Financial Disclosures (TCFD). To ensure accurate reporting, Key Performance Indicators within these reports are validated internally and by external third parties.

The report shows how we:

- Reduced enterprise-wide greenhouse gas (GHG) emissions by 47% compared to our fiscal year 2019 baseline.

- Achieved 90%+ landfill diversion (third-party assured) at 14% of our sites.

- Completed over 590,000 volunteer hours in our local communities worldwide.

DOWNLOAD REPORT

Our Five-Year Goals Driving Meaningful Action

Jabil's sustainability goals fall under three foundational pillars: Our People & Communities, Our Operations & Resources, and Our Innovative Solutions. For each goal, we set measurable KPIs and monitor their progress using data-driven dashboards.

Jabil's sustainability goals are intrinsically tied with those of our customers, many of whom are the world's leading brands. In recognition of this shared objective, an integral part of our mission is to partner with and offer them our support as they strive to achieve their sustainability goals.

Our People & Communities

CULTURE & BELONGING

25%

Of leadership positions held by women

40+

Established programs for persons with disabilities

HUMAN RIGHTS

≥160

Annual global site average RBA score that equates to a silver status rating

Our Operations & Resources

CLIMATE ACTION

25%

Reduction in operational

greenhouse gas (GHG) emissions* by the end of FY25

HEALTHY ENVIRONMENT & SAFE

OPERATIONS

80+

Target EHS index score

RESOURCE EFFICIENCY

6%

Average global reduction

of our acquired or purchased water

90%

or more landfill diversion achievement at 20% of applicable sites globally

*Jabil’s climate action targets pertain to Jabil’s Scope 1 and Scope 2 Market-Based GHG emissions. Jabil also has longer-term climate ambitions, including a 50% reduction in operational emissions by FY30 and operational carbon neutrality by 2045, all from a FY19 baseline.

Our Innovative Solutions

CYBERSECURITY

8+

Achievement of annual average cybersecurity score

CIRCULAR ECONOMY

10

Total circular economy projects engaged

Reports Archive