Innovation and Development of Electric Vehicle Powertrain Technology: An Analysis

The mass adoption of electric vehicles is happening at a greater speed than most anticipated. In the last 12 months alone, S&P have adjusted its 2025 EV Share of Global production from 20% to 30%. And, despite the economic climate in many countries, EY research states that 52% of global consumers are looking to buy an electric vehicle for their next car purchase.

As the industry is faced with the important task of mainstreaming electric vehicles (EV) to meet regulatory and consumer demands, there remains a fluidity in the industry around who will drive powertrain innovation and how this technology will be brought to market at an economically acceptable cost to consumers.

In Jabil and SIS International Research’s 2022 Electric Vehicle Powertrain survey, we asked more than 200 decision-makers from leading global automakers and commercial vehicle manufacturers about the factors driving innovation in EV powertrain technology and the remaining risks — and associated solutions — enabling mass adoption.

Key findings include:

- The average development cycle for EV powertrain technology is 24–30 months.

- 73% believe that new EV market entrants will lead EV powertrain technology innovation.

- Cost was identified as the main driver of EV powertrain innovation.

- Batteries and charging offer the most potential for innovation but also pose the most risk to mass adoption.

- 68% of respondents are considering the physical integration of powertrain components or modules within the next five to 10 years.

- Growing in-house design powertrain design capabilities is a priority for vehicle manufacturers.

Note: For the purpose of this research, “EV powertrain technology” included the inverter, converter, integrated power converter, on-board charging, battery management system and power distribution.

1. The Average Product Development Lifecycle for EV Powertrain Technology Is 24–30 Months

With predictions stating that 60% of new vehicles will be BEV or EV by 2030, the speed of powertrain technology development, and launch to scaled manufacturing, is key. Longer timelines may impact the industry’s ability to meet emissions reductions regulations, while shorter timelines will enable the automakers to launch vehicles and secure their place in the market.

The majority (86%) of survey respondents said their average development and launch timeline for powertrain technology is between 24 and 40 months. More specifically, 51% typically take between 24 and 30 months, while 35% spend 31 to 40 months on the process.

Only 4% have brought their EV powertrain development and launch cycles to 24 months or less, closer to the timeline of consumer electronics and IoT devices.

This timeline is a dramatic shift from similar research that Jabil ran just four years ago. In our research into automotive product development cycles in 2017 and 2018, we saw shortening product development lifecycles of technology predominantly for internal combustion engine (ICE) vehicles. In a 2018 Jabil survey, only 29% of automotive OEMs said their product development cycle took 24 months or longer. Nearly half (49%) said their time-to-market was 18 months or less.

While these pieces of research aren’t strictly comparable, it’s clear to see that with the accelerated launch of battery electric vehicles (BEVs), we are seeing longer product development life cycles. Looking forward, as BEVs become mainstream and solutions are found to manufacturing challenges, we would expect to see development cycles shorten again.

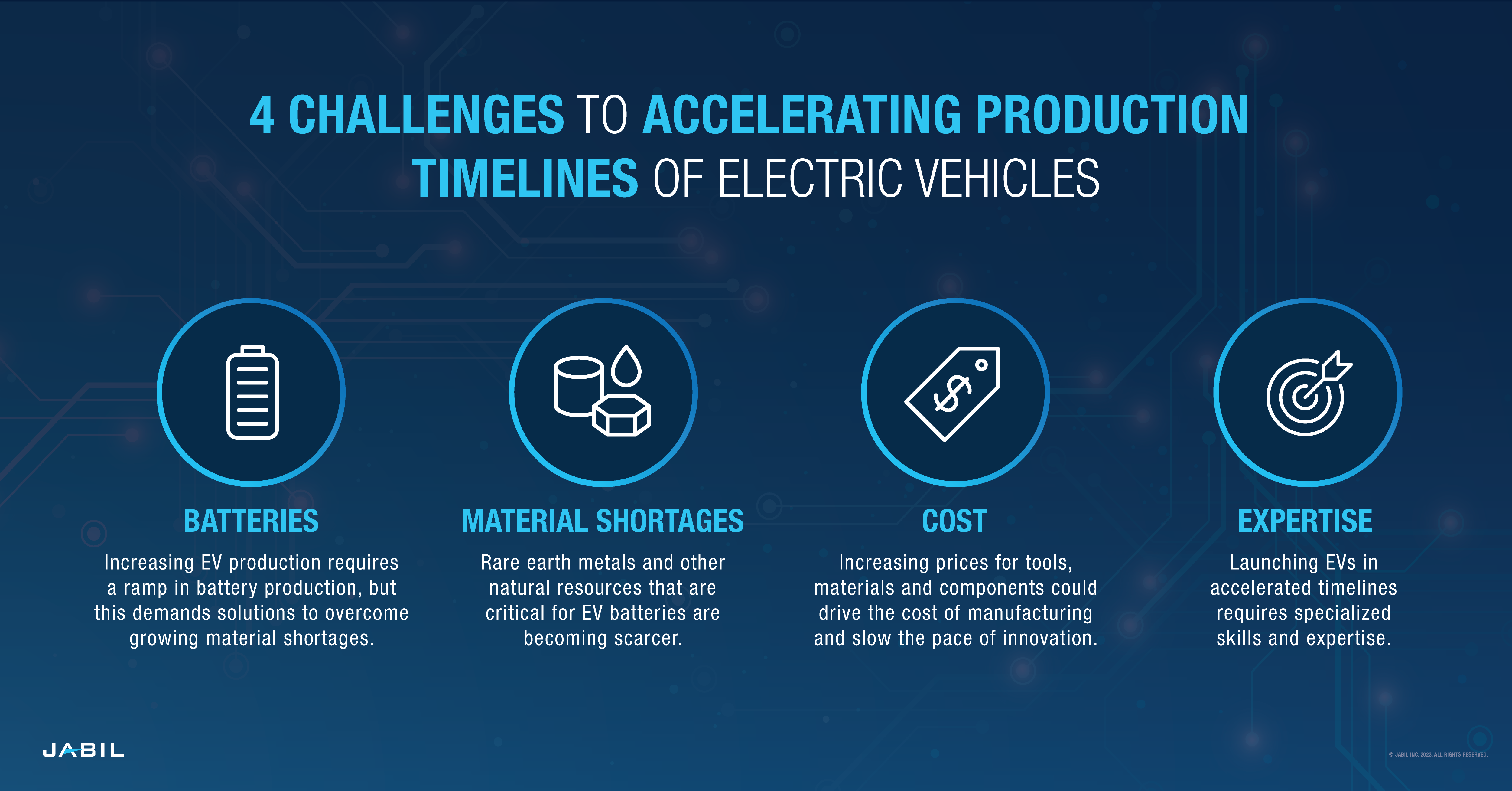

When asked about factors constraining EV powertrain product development, survey respondents identified four key areas:

- Battery manufacturing capacity — Respondents were concerned about manufacturers’ ability to produce the number of batteries that will be needed to meet the growing demand for EVs.

- Material shortages — This is a concern especially for materials that may become critical as we rely more on battery electric vehicles that require rare earth metals and other natural resources, like cobalt, in the production process.

- Cost of tools, materials and components — Increased costs could slow the pace of innovation and production.

- Lack of internal expertise — Respondents indicated that their companies may need assistance with expertise, skills and frameworks around electrification to complement the knowledge they have in house.

2. While Innovation Will Come from Both New and Traditional Sources in the Short Term, 73% Believe EV Companies Will Lead Long-Term

When asked about who will drive innovation in powertrain technology, the majority of respondents believe it will come from a variety of sources, both new and traditional. In the next five to 10 years, 67% of respondents believe that innovation will come from new EV market entrants, 68% from traditional automotive/commercial vehicle OEMs and 67% from automotive battery manufacturers.

When it comes to the longer term of over ten years, we see a slight uptick in expected innovation from EV entrants. Nearly three-quarters (73%) of automotive leaders believe that innovation will be led by new EV market entrants, while 69% expect it to stem from traditional automotive/commercial vehicle OEMs, 66% from automotive battery manufacturers and 51% from tier-one suppliers. In contrast, only 17% believe EV powertrain innovation will come from software companies and 8% from lower-tier niche suppliers.

It is clear from these responses that vehicle manufacturers will continue to be the principal driver of powertrain innovation in the EV era as they have been traditionally in the internal combustion engine era. But key to driving this innovation will be building and maintaining in-house engineering and scientific skill bases.

3. Cost Is Seen as the Primary Driver of EV Powertrain Innovation

Manufacturing costs continue to be a concern for electric vehicle OEMs; as of June 2022, consulting firm Alix Partners found that the raw material cost for EVs was, on average, 125% greater than that of ICE vehicles. The firm also reported that the cost of raw materials for EVs has itself jumped 95% since March 2020, driven mainly by the metals used in EV batteries.

Compounding the raw material cost is the investment required to transform ICE production lines to EV production, or in the case or new EV market entrants, build EV production capacity from scratch. An expensive exercise, especially given the production and handling of lithium batteries.

In the Jabil research, it’s understandable that cost was the most common driver of innovation for EV powertrain technology at 31%. Power electronics and motor efficiency followed behind at 28%, then energy storage density at 27%. Another 14% found that charging speed was a driver.

The pressure to reduce cost while increasing efficiency and density is incredible given the extremely short time in which the industry is transforming. Some technologies are already on their fifth or sixth generation, and the innovations have only just begun. Huge effort is going into replacing expensive materials with lower-cost and more readily available materials. Making power and energy denser also reduces material usage and therefore decreases cost.

4. Batteries and Charging Offer the Most Potential for Innovation but Also Pose the Most Risk to Mass Adoption

The survey asked respondents their thoughts on what factors have the most impact on EV powertrain technology innovation over the next 10 years. The highest response by far, at 41%, was new developments in battery chemistry. Following behind, just over a fifth (21%) cited motor efficiency developments as the most impactful new development, 20% highlighted integrated architectures, 10% selected electronics integration and the smallest number chose efficient wide band gap semiconductors at 7%.

This belief that battery chemistry will be highly impactful on the development of EV powertrain technology illuminates the risks OEMs perceive in the push toward mass adoption of electrified vehicles. Survey respondents identified that, while batteries provide great opportunity, charging infrastructure and battery manufacturing concerns present the greatest challenges to large-scale EV deployment:

- Among our respondents, 30% noted charging infrastructure as the biggest risk to the automotive industry. As battery and charging technology continues to evolve, there are growing options for powering up an electric vehicle. Home charging is a convenient choice, but it can take many hours to charge a vehicle at home, creating a need for public high-voltage, fast-charging infrastructure. There’s a big gap between need and reality right now. According to McKinsey, if half of all vehicles sold by 2030 are zero-emission vehicles (ZEVs) to meet federal targets, the U.S. would need 1.2 million public EV chargers and 28 million private chargers in homes and workplaces. That’s roughly 20 times more chargers than are currently installed across the country.

- Twenty percent of study respondents indicate that battery manufacturing capacity issues could present a risk for global mass adoption.

- While consumer purchase costs are a top concern to 16% of respondents, it is important to reinforce the fact that electrified vehicles save consumers money — up to $1,000 per year and $9,000 over a lifetime, according to the Center for Sustainable Energy. They also indicate that, due to the reduction of parts required to run electrified vehicles, consumers can also save up to $4,600 on repairs over the lifetime of the vehicle.

5. Most Automakers Are Considering the Physical Integration of Powertrain Components to Accelerate Powertrain Development and Speed to Market

One way that manufacturers are working to accelerate EV powertrain development is by integrating components or modules. This tactic means the vehicle contains fewer parts overall, making it lighter and more sustainable.

The Jabil research identified that 68% of respondents are considering integrating some combination of components or modules in their products within the next five to 10 years.

The most popular combination was an on-board charger and battery, which 51% believe will be integrated together in the coming years. And exactly half expect a converter and integrated power conversion to be integrated.

With these foreseen integrations come significant cost savings as well as power efficiency improvements.

6. Growing In-House Powertrain Design Capabilities Is a Priority for Vehicle Manufacturers

With the spectrum of opportunity and challenges faced by automakers in developing and launching BEVs, the Jabil research uncovered findings about OEMs’ product design, manufacturing and supply chain strategies.

The research showed some clear alignment across the industry on approaches.

- In-house design — Respondents clearly indicated that they would be growing and/or leveraging in house design capabilities for all core modules of an EV powertrain. Overall, an average of 51% of OEMs believe the design engineering work for these components will be brought in house 10-plus years from now.

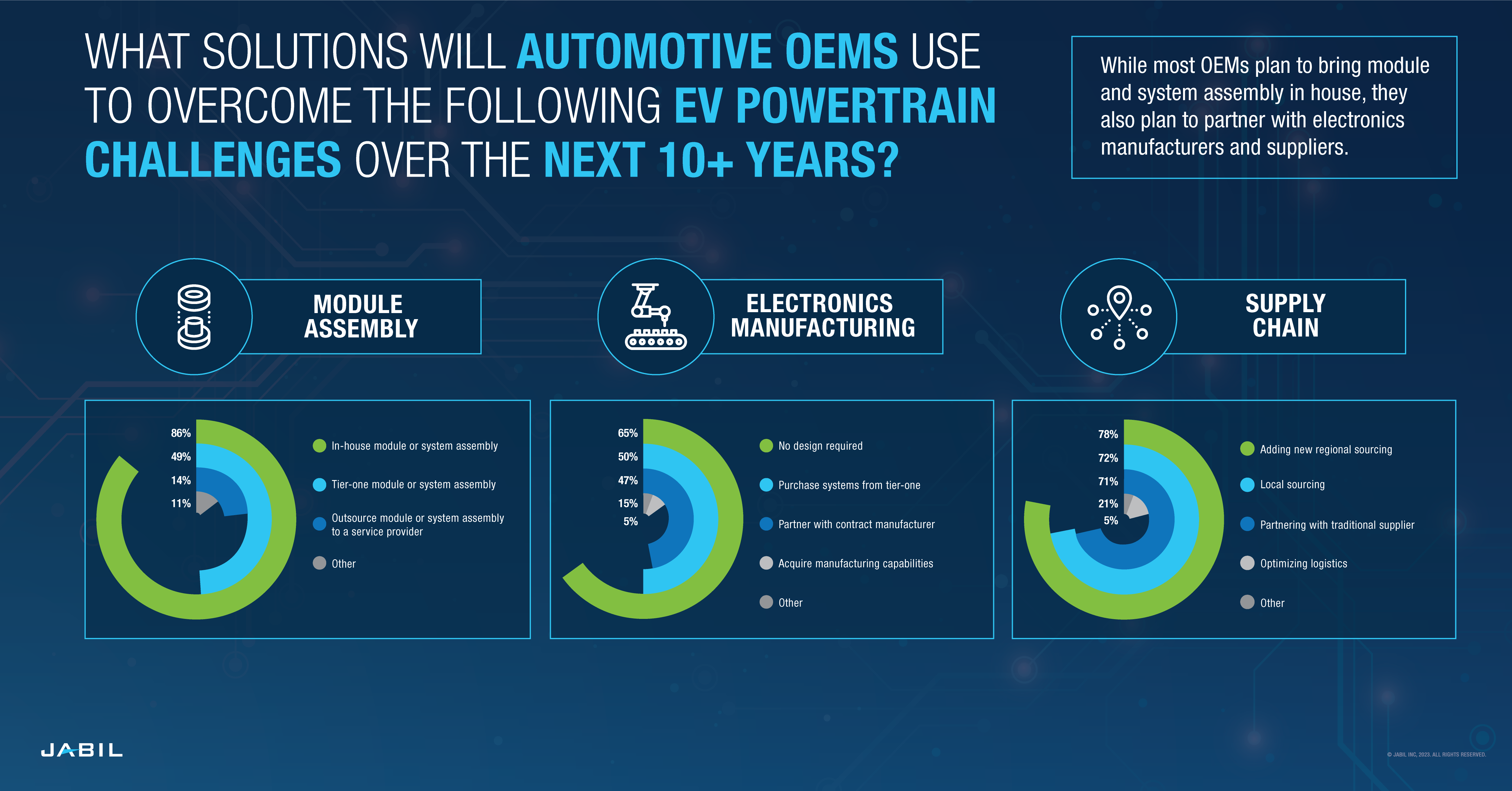

- Module assembly — 85% of respondents are likely to opt for in-house module or system assembly, 49% said they would go for a model where a tier-one owns their module or system assembly, and 14% would choose to outsource module or system assembly to a service provider.

- Electronics manufacturing — 65% of respondents indicated they are likely to partner with contract manufacturer for electronics manufacturing (but not for module or system assembly), 50% to purchase systems from tier-ones and 47% to acquire manufacturing capabilities.

- Supply chain — 78% of respondents elected to partner with traditional supplier and/or other ecosystem member(s), 72% chose adding new regional sourcing and 71% were for optimizing logistics. Only 21% of respondents said it was likely they would adopt local sourcing for their supply chain, possibly due to the fact that three-quarters of the survey respondents were based in Europe or North America.

Automotive OEMs are poised to eliminate one of the largest sources of manmade greenhouse gas emissions exacerbating the global climate crisis. While constraining factors like limited battery capacity, charging infrastructure and a lack of design expertise present significant hurdles, by leveraging electronics manufacturing, system assembly and the supply chain, OEMs could be on the brink of reaching global mass adoption of electrified vehicles sooner than we thought.

How can Jabil help you meet your EV powertrain goals? Contact us.

No matter how complex or demanding the project, Jabil's automotive and transportation team is helping today’s innovators solve it. Get started with a trusted partner.