Jabil Insights

The latest trends, research, and perspectives on technology, supply chain, and manufacturing

-

Insight

The Software-Defined Vehicle: Impacts Across the Automotive Ecosystem

Dec 12, 2025

-

Insight

The Future of Supply Chain Management is Risk Management

-

Insight

Interoperability: The Future of Smart Appliances

-

Insight

Five Automotive Connectivity Trends Fueling the Future

-

Insight

Sustainability Begins at (the Smart) Home

-

Insight

Reducing Scope 3 Emissions is Key to Industrial Decarbonization

-

Insight

To Reduce Scope 3 Emissions, Think Data First

-

Insight

Five Ways Sustainable Design Can Reduce GHG Emissions

-

Insight

Talking Trash: Building a Sustainable Waste Diversion Program

-

Insight

4 Strategies for Reducing Scope 1 and Scope 2 Emissions

-

Insight

How Data May Solve the World's Circular Economy Challenges

-

.jpg)

Insight

Five Ways a Manufacturing Partner Can Support Your Sustainability Goals

-

Insight

Manufacturing Wind Turbines: Three Considerations

-

INSIGHT

Retail Robotics Are Here: From Warehouses to Delivery

-

Insight

Sustaining Strategy for the Medical Device Industry

-

INSIGHT

Making Miniaturization Possible with Advanced Electronics Assembly

-

INSIGHT

The Impact of AI in Manufacturing: Unleashing Productivity

-

INSIGHT

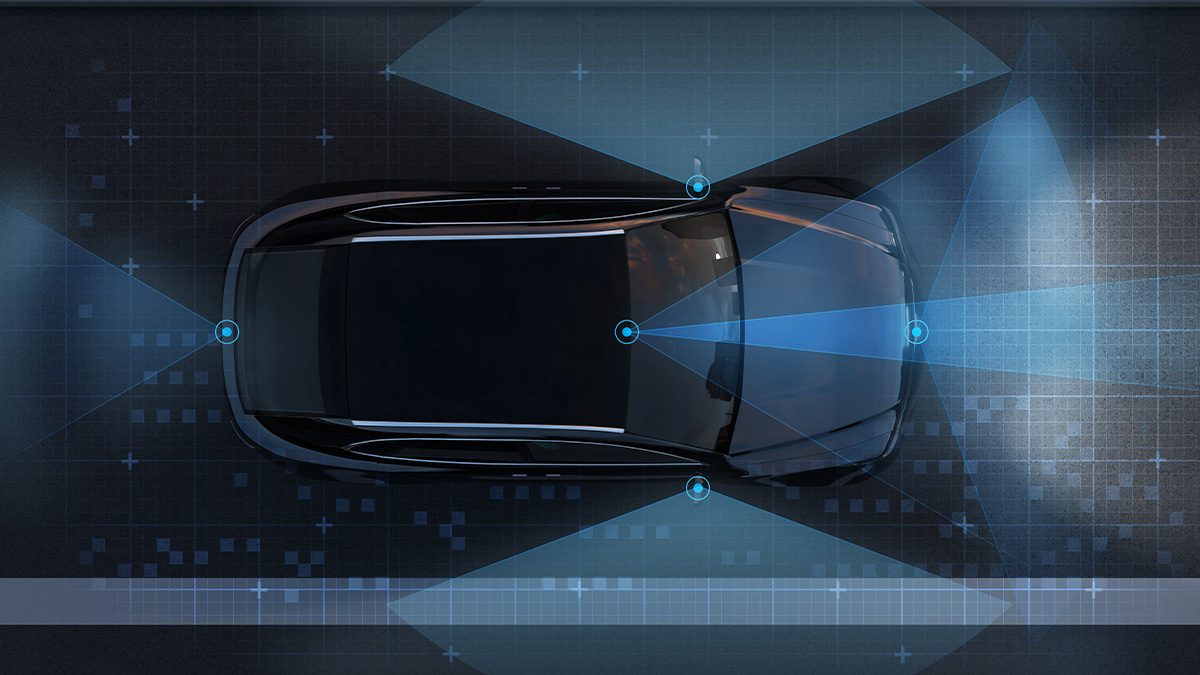

Precision & Complexity: Manufacturing Advanced Driver Assistance Systems

-

INSIGHT

Manufacturing Transfer Checklist: The Devil is in the Details

-

Insight

Fulfilling the Promise of Precision Medicine Solutions in Diagnostics

-

Insight

What is Liquid Biopsy? Precision Medicine's Tool of the Future

-

Insight

Companion Diagnostics Key to Individualized Healthcare

-

INSIGHT

Supply Chain Optimization: Harnessing Resilience

-

INSIGHT

The Electric Vehicle Supply Chain: Manage Risk, Accelerate Production

-

INSIGHT

E-Waste Management: An Industry Ripe for Disruption

-

INSIGHT

Powering Ahead: The Rise of Energy Storage Systems

-

INSIGHT

The Road to Installing 20 Million Public EV Chargers Worldwide

-

INSIGHT

Supplier Relationship Management: Six Secrets

-

INSIGHT

How to Build Supply Chain Resilience Before the Next Disruption

-

INSIGHT

Supplier Relationships: 4 Real-World Lessons

-

INSIGHT

The Future of Digital Health: Insights from Jabil's 2024 Healthcare Survey

-

INSIGHT

The Future of Commerce — Automated, Unified, and Powered with AI

-

INSIGHT

The Convergence of Design and Manufacturing: A New Era for the Development of Automotive Optics

-

INSIGHT

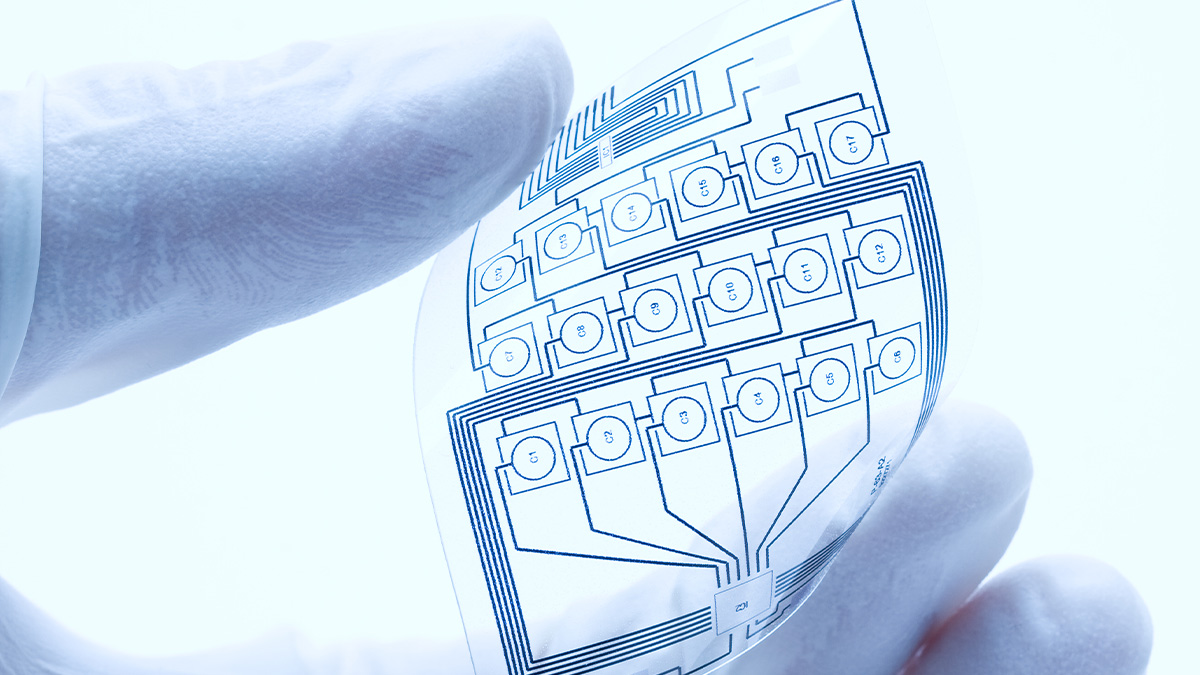

Flexible Electronics Put “Smart” in Unexpected Places

-

INSIGHT

Get Smart: Connectivity is at the Core of Smart Buildings

-

INSIGHT

Supply Chain Technology Stack: A Digital Roadmap to Resilience

-

.jpg)

INSIGHT

Breakthrough Sensory Technology Solutions for Next-Gen SWIR 3D Cameras

-

INSIGHT

Lean Six Sigma: Predictable Manufacturing & Dependable Quality in a Changing World

-

INSIGHT

Humanoid Robot Mass Adoption Hinges on Affordability and Scale